The allure of cryptocurrency mining persists, drawing in investors with the promise of digital gold. But the glittering facade often obscures a complex reality. Navigating the intricacies of hashing power, network difficulty, and fluctuating cryptocurrency values requires a pragmatic approach, especially when assessing potential investment yields. Forget the get-rich-quick schemes; sustainable mining demands meticulous planning and a clear understanding of the financial landscape.

Before diving into the hardware, it’s crucial to understand the fundamental mechanics of crypto mining. At its core, mining is the process of verifying and adding new transaction records to a blockchain. Miners solve complex cryptographic puzzles, and the first to solve the puzzle gets to add the next block to the chain, earning a reward in the form of newly minted cryptocurrency, along with transaction fees. This competition ensures the integrity and security of the network. Different cryptocurrencies employ different mining algorithms, each with its own energy consumption and hardware requirements. The king, Bitcoin (BTC), relies on the SHA-256 algorithm, demanding powerful Application-Specific Integrated Circuits (ASICs) – the aforementioned mining machines.

The heart of any mining operation is the mining rig itself. Selecting the right hardware is paramount to profitability. ASICs, GPUs (Graphics Processing Units), and even CPUs (Central Processing Units) can be used for mining, depending on the cryptocurrency. ASICs offer the highest hash rate (computational power) for Bitcoin mining but are specific to the SHA-256 algorithm. GPUs are more versatile and can be used for mining a wider range of cryptocurrencies like Ethereum (ETH), although ETH has largely moved to Proof-of-Stake. Factors like hash rate, power consumption, and initial cost must be carefully considered. A cheaper rig with low hash rate might be less profitable than a more expensive, efficient one in the long run. The cost of electricity is also a huge consideration; high electricity costs can render even the most powerful mining rig unprofitable.

Many aspiring miners choose to outsource the management and maintenance of their equipment through mining hosting services. These services provide the infrastructure, including power, cooling, and internet connectivity, in exchange for a fee. Hosting can be particularly attractive for individuals who lack the technical expertise or physical space to manage their own mining operations. However, it’s crucial to choose a reputable hosting provider with a track record of reliability. Consider factors like uptime guarantees, security measures, and the location of the data center, as power costs vary significantly between regions.

The concept of difficulty is crucial. As more miners join a network, the difficulty of solving the cryptographic puzzles increases. This dynamic adjustment ensures that the block creation rate remains relatively constant, regardless of the number of miners participating. As difficulty increases, individual miners have a lower probability of solving a block, leading to decreased rewards. Understanding network difficulty is essential for predicting future profitability.

Beyond Bitcoin and Ethereum, a plethora of alternative cryptocurrencies, often called altcoins, offer mining opportunities. Coins like Dogecoin (DOGE) initially used simpler mining algorithms, making them accessible to GPU miners. However, as these coins gained popularity, they often attracted larger mining operations, increasing difficulty and potentially diminishing profitability for individual miners. Investigating the potential of mining various altcoins can be beneficial, but it’s crucial to research the project’s fundamentals, community support, and long-term viability. Remember, a high hash rate on a failing coin translates to zero profit.

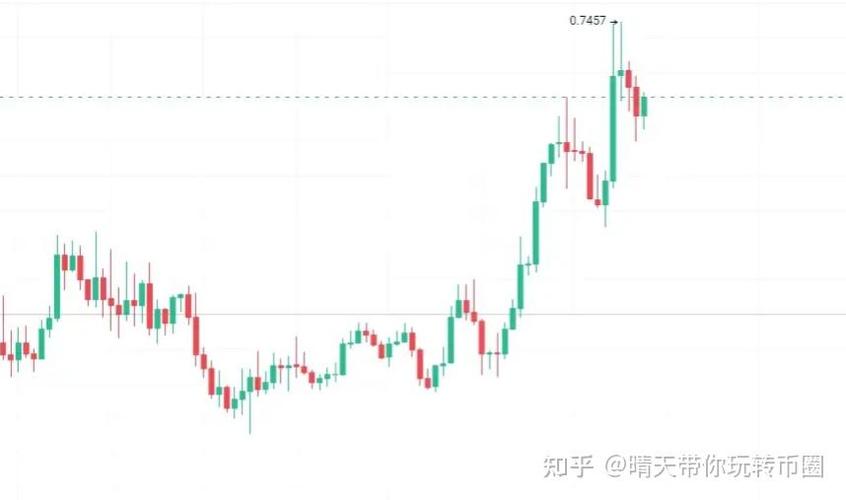

The volatile nature of cryptocurrency markets is a significant risk factor. The value of mined coins can fluctuate wildly, impacting profitability. A miner who accumulates coins in anticipation of a price increase might find themselves holding devalued assets if the market takes a downturn. Risk management strategies, such as hedging or diversifying into more stable cryptocurrencies, can help mitigate these risks. Furthermore, tax implications should be carefully considered, as mining income is typically subject to taxation.

Evaluating investment yields requires a comprehensive financial model. Start by calculating the total cost of ownership (TCO) of the mining operation, including hardware costs, electricity costs, hosting fees (if applicable), and maintenance expenses. Next, estimate the potential revenue based on the current block reward, network difficulty, and cryptocurrency price. Project these figures over a reasonable timeframe, accounting for factors like increasing difficulty and potential price fluctuations. Finally, calculate the return on investment (ROI) and payback period. Remember to stress-test your model with different scenarios, such as a significant drop in cryptocurrency prices or a surge in network difficulty.

Cryptocurrency exchanges play a crucial role in converting mined coins into fiat currency or other cryptocurrencies. Choosing a reputable exchange with low fees and high liquidity is essential. Liquidity refers to the ease with which an asset can be bought or sold without significantly affecting its price. Exchanges with high liquidity offer better prices and faster execution of trades. Security is also paramount, as exchanges are often targets for hackers. Opt for exchanges with robust security measures, such as two-factor authentication and cold storage of funds.

Successfully navigating the world of crypto mining requires a blend of technical expertise, financial acumen, and risk management skills. While the potential rewards can be substantial, the risks are equally significant. By adopting a pragmatic approach, conducting thorough research, and continuously monitoring the market, aspiring miners can increase their chances of achieving sustainable profitability. Remember, crypto mining is not a passive investment; it demands active management and a commitment to staying informed about the evolving landscape.

This guide demystifies crypto mining, blending practical yield evaluation tools with real-world insights, making investments accessible yet thrilling—ideal for novices, but watch for market volatility’s wild twists!