As we edge closer to 2025, the cryptocurrency landscape continues to evolve at a breakneck pace, with mining equipment emerging as the beating heart of this digital gold rush. For businesses like ours, specializing in selling and hosting mining machines, understanding the pricing trends of these essential tools is crucial for maximizing return on investment (ROI). Imagine a world where Bitcoin’s volatile surges and Ethereum’s smart contract revolutions drive demand for more efficient rigs; it’s not just about hardware anymore, but about strategic foresight. This article delves into the intricate dance of market forces, technological advancements, and economic shifts that will shape mining equipment costs, offering insights tailored to savvy investors and operators alike.

The core of any mining operation lies in the machines themselves—powerful beasts designed to crunch complex algorithms and unearth digital treasures. Bitcoin, or BTC, remains the undisputed king, with its proof-of-work consensus demanding robust ASICs that can handle immense computational loads. Over the past few years, we’ve seen prices for these miners fluctuate wildly, influenced by factors like semiconductor shortages and energy crises. By 2025, experts predict a stabilization, thanks to innovations in chip manufacturing, potentially dropping costs by 15-20% for high-end models. Yet, this isn’t just about BTC; altcoins like Dogecoin (DOG) and Ethereum (ETH) are reshaping the scene. DOG’s meme-fueled popularity has sparked a surge in accessible mining rigs, while ETH’s transition to proof-of-stake might reduce demand for traditional equipment, creating a ripple effect on overall pricing dynamics.

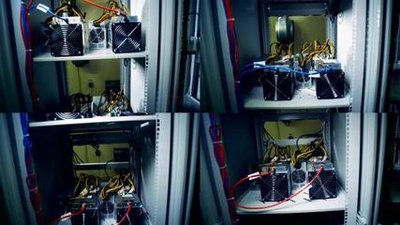

Now, let’s pivot to the broader ecosystem: mining farms and hosting services, which form the backbone of scalable operations. These vast warehouses, buzzing with thousands of miners, offer a hosted solution that mitigates the hassles of setup and maintenance. For instance, our company provides top-tier hosting for ETH and BTC miners, where clients can plug into optimized environments without the overhead. Pricing trends here are tied to real-world elements like electricity rates and regulatory changes; in 2025, as renewable energy sources become more prevalent, we could see hosting fees decrease by up to 10%, enhancing ROI for users. But beware the unpredictability—global events, such as geopolitical tensions, could spike costs overnight, turning a steady investment into a high-stakes gamble.

Diversity in the crypto world means exploring beyond the giants. Dogecoin, with its lighthearted origins, has surprisingly influenced mining rig designs, pushing for more energy-efficient models that appeal to casual miners. This burst of innovation ensures that equipment pricing isn’t monolithic; a basic mining rig for DOG might cost a fraction of a high-performance ETH miner, yet both contribute to a portfolio’s overall profitability. Picture this: a beginner setting up their first rig in a home setup, versus a corporate farm with rows of synchronized machines—each scenario demands different pricing considerations, from initial purchase to long-term upkeep.

Amid these trends, the concept of burstiness in mining equipment adoption can’t be ignored. Short, intense periods of market euphoria, like the crypto booms we’ve witnessed, lead to rapid price hikes for new miners, followed by corrections that make bargains abundant. By 2025, with advancements in AI-driven optimization, miners could become smarter, adapting to network difficulties in real-time and thus justifying premium prices. For our hosting services, this translates to packages that not only house your equipment but also integrate with exchanges for seamless trading, turning raw hashing power into tangible profits from BTC, ETH, or even emerging tokens.

Maximizing ROI requires a keen eye on these fluctuations. Investors should consider factors like hash rate efficiency and electricity consumption ratios, which directly impact operational costs. A top-tier mining rig, optimized for BTC’s rigorous demands, might command a higher upfront price but deliver superior long-term returns. Meanwhile, for ETH enthusiasts, the shift towards staking could mean reallocating resources from hardware to software solutions, potentially depressing miner prices and opening doors for diversification into DOG or other Proof-of-Work coins.

Looking ahead, the interplay between mining farms and individual miners will define 2025’s landscape. Farms, with their economies of scale, might see pricing advantages through bulk purchases, while solo miners leverage portable rigs for flexibility. This rhythm of adaptation—alternating between centralized operations and decentralized setups—ensures the market remains vibrant and unpredictable. As we wrap up, remember that in the world of crypto, knowledge is your most valuable asset; stay informed, diversify your holdings, and watch as your ROI soars amidst the ever-shifting tides of innovation and opportunity.

This insightful article delves into the factors shaping mining equipment pricing trends for 2025. With comprehensive analyses and expert forecasts, it equips stakeholders with actionable strategies to enhance ROI. Diverse perspectives on market dynamics, technological advancements, and economic influences make it a must-read for industry professionals aiming for profitability.